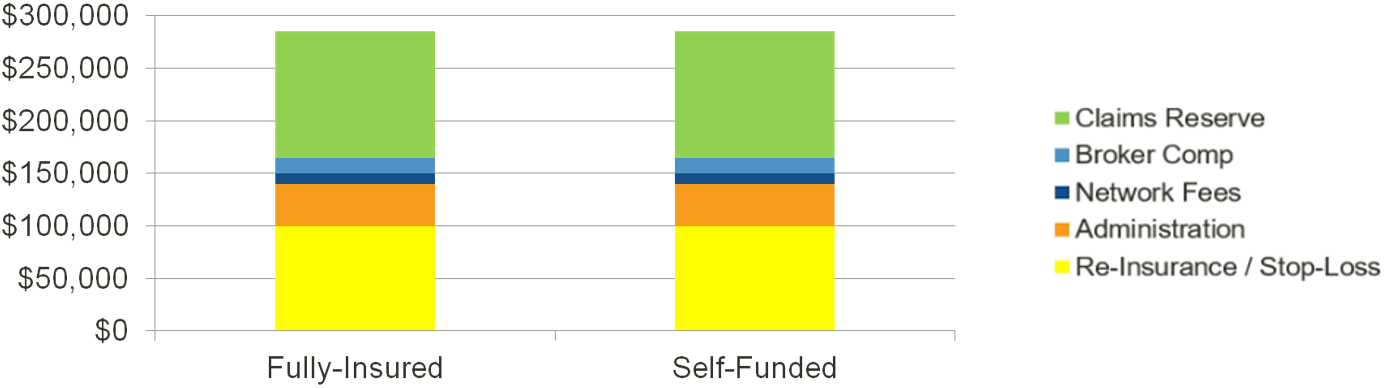

With a fully insured plan, the insurance company pays for most of the benefits and offers members small out-of-pocket expenses in the form of deductibles, copays and coinsurance but keeps the profits when the claims are lower than expected. With our level funded plan, HealthyAdvantage, the employer pays the benefits up to a higher deductible, but purchases stop-loss insurance to reimburse the plan if the deductible is met.

Level Funded health plans allow employers to pay a preset level premium equivalent which includes fixed costs and maximum claims fund. Since the employer is prepaying the claims, 100% of the unused claim funds at the end of the contract period will be returned to the employer as savings!

When you are evaluating your benefits, ask yourself who should own the claims fund - the employer or a carrier? For more information, contact sales@gbsio.net or request a quote.

Amwins Connect Administrators utilizes online technology to quote, underwrite and enroll HealthyAdvantage. Please contact us to schedule a demonstration to see how easy level funding can be!

In addition to Amwins Connect Administrators' proprietary product, we also administer and work with all of the carriers' level funded products including Aetna AFA, UnitedHealthcare's All Savers and Cigna's Level Funded plan. We can provide information and assist you in getting quotes for these products.